Recognise Bank is enroute to transforming UK SME business banking with the implementation of a world-class FP&A solution by FSI experts, Vuealta

We caught up with Matthew Biggs, Head of Financial Planning and Analysis (FP&A), at Recognise Bank, to find out more about the Bank’s implementation of Anaplan, led by Vuealta. “As a new player in the market, it’s very important we are continually looking forward, focusing on internal and external activity that will impact the Bank,” Biggs explains.

“Changes that take just 30 seconds in Anaplan would take an hour or more in Excel. There’s just so much more manual checking needed in a spreadsheet, those time savings alone have enabled us to develop and transform our Financial Planning and Analysis capability.”

Matthew Biggs, Head of Financial Planning and Analysis @ Recognise Bank

Founded in 2017, Recognise Bank is a digital SME bank supporting thousands of small and medium-sized businesses across the UK. It combines the modern, digital-first ethos of fintech players, along with personal relationships that have largely been lost within mainstream business banks. Using the latest technology is key to its strategy – from core banking to business operations, HR, and planning. To support its rapid growth, the Bank appointed Vuealta to transform its approach to planning and forecasting, with Anaplan’s Connected Planning platform.

Recognise Bank is on a mission to change the face of SME business banking. After being fully authorised in September 2021, the Bank lent £100m to UK SMEs in the first six months up to April 2022, from a pipeline of over £1bn in loan applications. The Bank could see that supporting this demand and sustaining high levels of growth going forward, would need a brand-new approach to forecasting, budgeting, and planning.

Recognise Bank’s finance team was looking for a single platform that could replace the patchwork of the spreadsheets it had initially used (Read more about how Recognise Bank partnered with Vuealta for deep financial services expertise here). It also had a firm eye on rolling out the new planning capability to other areas of Recognise Bank operations, such as workforce and operational planning.

We caught up with Matthew Biggs, Head of Financial Planning and Analysis (FP&A), at Recognise Bank, to find out more about the Bank’s implementation of Anaplan, led by Vuealta. “As a new player in the market, it’s very important we are continually looking forward, focusing on internal and external activity that will impact the Bank,” Biggs explains.

Biggs has named the approach LEO – or Latest Expected Outcome – reflecting how events day-to-day can shape the full-year picture. “We wanted a platform that could examine performance, exploring and running different scenarios, that could utilise and integrate the Bank’s source data and help build an overall operating model that will enable the leaders of the Bank to make better informed decisions.”

Relying on spreadsheets for such sophisticated business planning was not a long-term solution, as Biggs explains: “Spreadsheets are time consuming to maintain and lack resilience and it’s difficult to make tweaks or find the answers to highly specific questions. Finally, spreadsheets have limited security features and can’t guarantee the integrity of the data – both features which a planning platform would have built-in.”

Recognise Bank carried out extensive market research into planning systems, identifying Anaplan as the best fit for its cloud-first tech stack. When it came to selecting an implementation partner, Vuealta stood out head and shoulders from the crowd.

Biggs says: “Vuealta impressed us with a bespoke Anaplan demonstration that was based on a bank, while others presented simulations that were totally unrelated to our industry. Vuealta’s experience in the banking sector, and its proactive approach to our requirements, were extremely reassuring.”

Vuealta’s team began the Anaplan implementation in October 2021, with a view to the new planning platform going live in time for the start of Recognise Bank’s financial year in April 2022.

With input from the Recognise Bank finance team, the Vuealta team developed models in Anaplan for a wide variety of functions and use cases. Though it anticipated a 12-week project timeline, the Vuealta team worked quickly, completing the implementation ahead of time.

“It was ‘go’ from day one,” says Biggs. “The Anaplan implementation was very smooth. Building the models was quite fun, as the Vuealta team and the Recognise team would challenge each other a lot. However, it was very clear the team knew what they were doing and here was hardly any trial and error.”

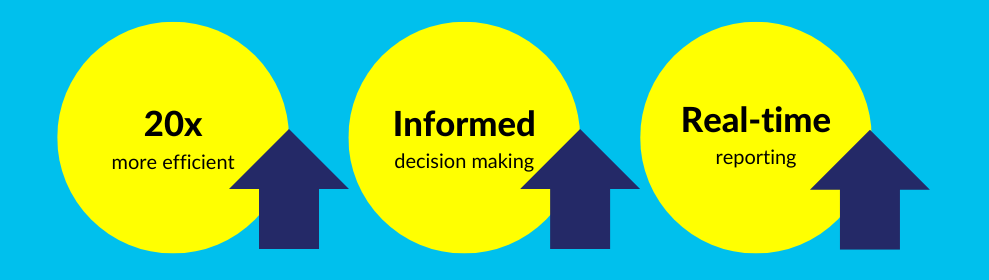

The new Vuealta-implemented Anaplan platform is already making waves across Recognise Bank. Executives at the Bank can now explore a wide variety of scenarios, enabling them to make more informed decisions, improving the Bank’s financial performance. This flexibility is particularly useful in the today’s challenging economic environment.

Biggs explains: “We’re already using Anaplan to explore our Latest Expected Outcome results. With Anaplan, we can run our leaders through different scenarios and show the variants between them straightaway.”

In addition, updating models in Anaplan is far quicker, as there’s no need for time-consuming debugging, which is a common issue when working in Excel. Finally, the Bank’s leaders can “see the data their way”, building their own models and dashboards within Anaplan, without affecting the integrity of the underlying operating model.

“Changes that take just 30 seconds in Anaplan would take an hour or more in Excel. There’s just so much more manual checking needed in a spreadsheet,” says Biggs. “Those time savings alone have enabled us to develop and transform our Financial Planning and Analysis (FP&A) capability.”

Currently, the Recognise Bank team updates Anaplan monthly with raw data extracted from its business applications. However, the Bank foresees a time when Anaplan will be fully integrated into its technology environment via APIs. That will enable Recognise Bank Executives to model and scenario plan across almost every area of its operations, from finance to HR, using real-time data that is up to date.

Thanks to Vuealta and Anaplan, the role of Financial Planning and Analysis within Recognise Bank is evolving fast. “Our team is working a hundred times better, and we’re producing far more information than before,” says Biggs.

He continues: “We’re no longer simply producing static reports every month. We’re developing living, breathing plans which reflect our day-to-day business. As our FP&A becomes more sophisticated, it’s becoming more valuable to the Bank. We’re working harder than ever.”

Biggs credits Vuealta with the success of the Anaplan implementation at Recognise Bank. “Most planning platforms do broadly the same thing. The big risk is that they’re not implemented properly. We selected Anaplan because of the strength of Vuealta’s team. I have really enjoyed working together, and we speak regularly. It’s a very close, collaborative relationship.”

Discover how banks and lenders can protect themselves against further market volatility in 2023 and beyond.